What is an Employee Pay Stub?

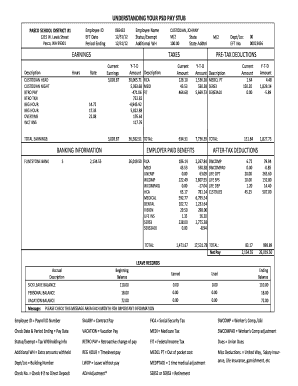

A pay stub is a piece of paper attached in some way to the relevant paycheck. It details the employer information, employee information, pay period dates, earnings, hours worked, and deductions taken out. This pay stub can be used for reference on taxes and in situations where proof of income is required — such as leasing a home or apartment.

In one sentence, what is the purpose of submitting this form?

The purpose of an employee pay stub is to provide employees with documentation and proof of their earnings for a certain pay period.

What information do you need in order to complete this form?

There are only a few pieces of information required to complete this form. This particular form is a pay stub for Canadian citizens. It is fairly straightforward to fill out, and can even be automated with billing software. To fill out a pay stub by hand you will need…

The full employer name. This is the name of the business itself, not the manager or person in charge. For example, if the employee is working at a limited liability corporation called “Tom’s Burgers”, the employer name is “Tom’s Burgers LLC”.

The full physical address and telephone number of the employer.

The full legal name of the employee, and their physical address.

The complete SIN for the employer -- though this varies depending on location. A SIN, or Social Insurance Number, is the number given to employees in Canada to determine their government benefits.

The date that the pay period ended, and the date that the employee was paid. Occasionally these dates will be different, for example, employees may be paid a week after their pay period actually ended.

The total earnings, rate at which the earnings were paid, hours worked, current earnings for the month, and total earnings for the year.

The gross pay (pay before deductions) for the paycheck, the gross pay for the current month, and the gross pay for the entire year to date.

Federal and provincial tax deductions for the pay period, current month, and year to date.

Total Employee Insurance (EI) deductions for the pay period, current month, and year to date.

Total Canadian Pension Plan (CPP) deductions for the pay period, current month, and year to date.

Any other deductions including room and board.

The total amount of deductions for all deduction fields filled out.

Net pay after deductions for the pay period, current month, and year to date.

Who is the intended recipient of this form?

Both the employee and employer must receive these forms for legal purposes. Employees are advised to keep the pay stubs they receive in case of pay disputes or for proof of income.